Starting or growing a business in Canada? A reliable commercial vehicle can be a game-changer. But let’s be honest—vehicles aren’t cheap. Luckily, a car loan for commercial vehicles in Canada can help businesses secure the transport they need without breaking the bank.

In this detailed guide, you’ll discover how to apply, compare top lenders like RBC, Scotiabank, Capital One, and learn actionable tips to get the best deal for your business vehicle loan.

What is a Car Loan for Commercial Vehicles?

A car loan for commercial vehicles is a financing option that allows businesses to purchase vans, trucks, or other vehicles essential for operations. These loans are tailored for companies, freelancers, and startups needing reliable transport.

Why it Matters:

Owning the right vehicle boosts efficiency, enhances brand image, and can even increase revenue.

Key Benefits of Commercial Vehicle Loans

Flexible Financing Options

Lenders like RBC, CIBC, and Scotiabank offer customized repayment terms based on your business needs.

Preserve Cash Flow

Instead of large upfront costs, spread payments over time—keeping your working capital intact.

Tax Advantages

Many business vehicle loans allow for tax deductions on interest and depreciation (check with your accountant).

Boost Business Efficiency

Having the right vehicle minimizes downtime and keeps operations running smoothly.

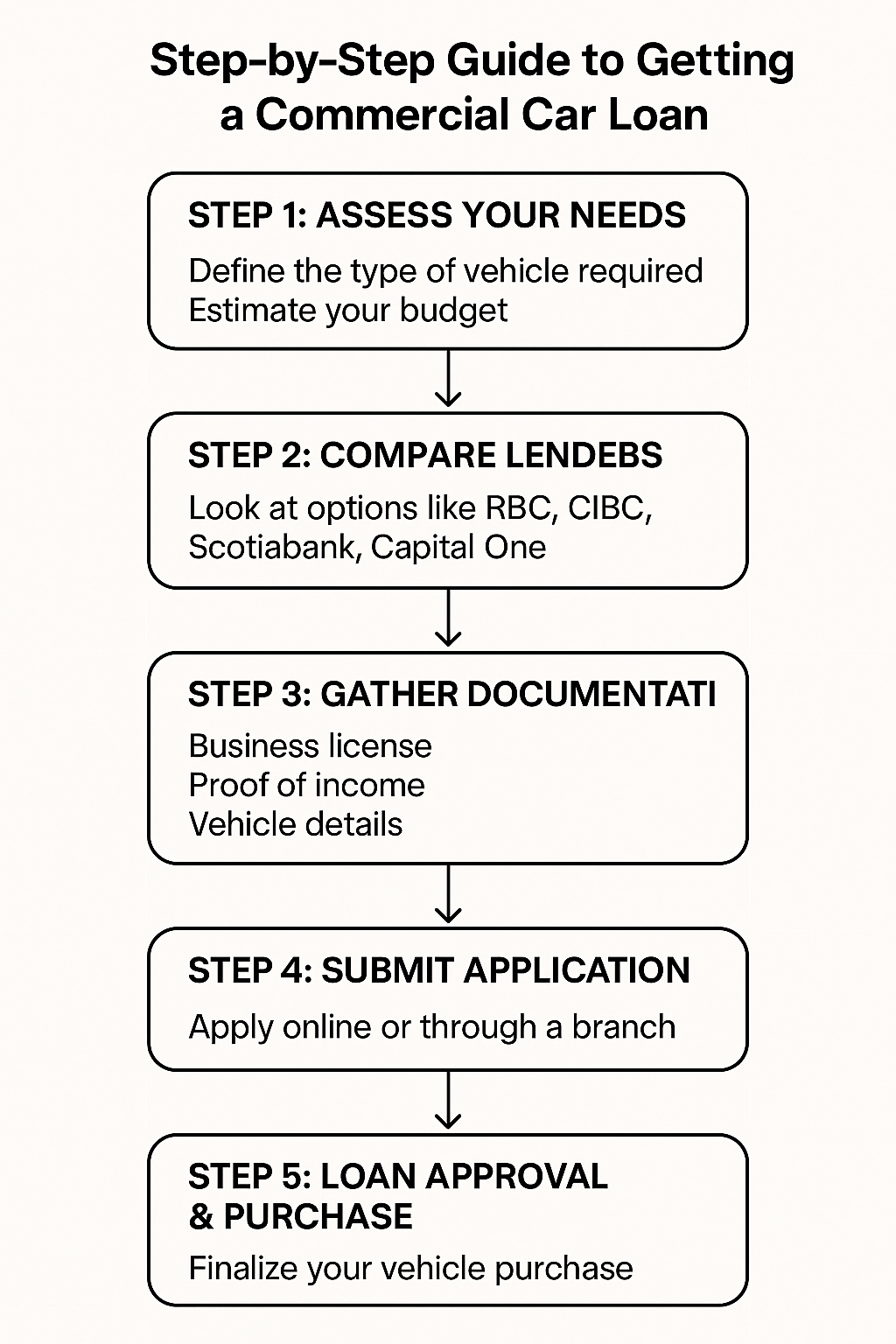

Step-by-Step Guide to Getting a Commercial Car Loan

Step 1: Assess Your Needs

- Define the type of vehicle required (truck, van, specialty vehicle).

- Estimate your budget.

Step 2: Compare Lenders

Look at options like:

- Capital One car loan for flexible terms

- RBC car loan rates for competitive offers

- CIBC car loan options for businesses

- Scotiabank car loan Canada for quick approvals

Step 3: Gather Documentation

- Business license

- Proof of income or financial statements

- Vehicle details

Step 4: Submit Application

Apply online or through a branch, ensuring all paperwork is accurate.

Step 5: Loan Approval & Purchase

Upon approval, finalize your vehicle purchase and hit the road!

Top Banks & Lenders Offering Commercial Vehicle Loans

| Lender | Key Features |

|---|---|

| RBC Car Loan | Competitive rates, business-friendly terms |

| CIBC Car Loan | Tailored for small businesses |

| Scotiabank Car Loan | Quick processing, flexible payments |

| Capital One Car Loan | Ideal for startups, flexible criteria |

Pro Tips to Get the Best Deal

- Improve Business Credit: A strong credit history boosts approval chances.

- Compare Refinance Car Loan Canada Options: Refinancing can lower your rates over time.

- Negotiate Terms: Don’t settle for the first offer; negotiate for better terms.

- Leverage Seasonal Promotions: Banks often run specials during key months.

Expert Insight:

“Businesses with detailed financial records often secure better rates” — Financial Advisor, Canadian Business Weekly.

Common Mistakes to Avoid

- Not comparing multiple lenders

- Ignoring hidden fees or insurance requirements

- Overestimating vehicle affordability

- Forgetting to check tax benefits

Real-World Success Story

Toronto-based logistics startup secured a Scotiabank car loan Canada and grew their fleet by 40% within a year, thanks to structured financing and smart planning.

Conclusion & Final Thoughts

A reliable vehicle can be your business’s best asset. By exploring your car loan for commercial vehicles in Canada options wisely, you’ll drive growth while managing cash flow effectively.

Ready to finance your next commercial vehicle?

Compare offers from Capital One, RBC, CIBC, and Scotiabank to find the best fit today.

FAQs: Car Loans for Commercial Vehicles in Canada

Can I get a car loan for a used commercial vehicle?

Yes, many banks, including CIBC and Capital One, offer loans for new and used vehicles.

Is refinancing an option for commercial vehicle loans?

Absolutely! Refinance car loan Canada options can help lower interest rates or extend payment terms.

Do I need a registered business to apply?

Typically, yes. Most lenders require proof of an active Canadian business.

How much down payment is required?

Down payments vary, but many lenders offer low or zero-down promotions for qualified applicants.

Which bank offers the lowest rates?

Rates depend on credit, business financials, and the lender. Comparing RBC car loan rates and Scotiabank car loan Canada offers is recommended.