Ever wondered, “Will gold price go up or crash in 2025?” You’re not alone. Amid global chaos—from the Israel-Iran tensions to the ballooning U.S. deficit—Bank of America (BofA) just made a bold prediction: Gold could reach $4,000 an ounce.

Yep, you read that right.

If you’re an investor, a curious observer, or just someone eyeing the gold market, this article breaks down everything you need to know—from expert forecasts to what this means for your wallet.

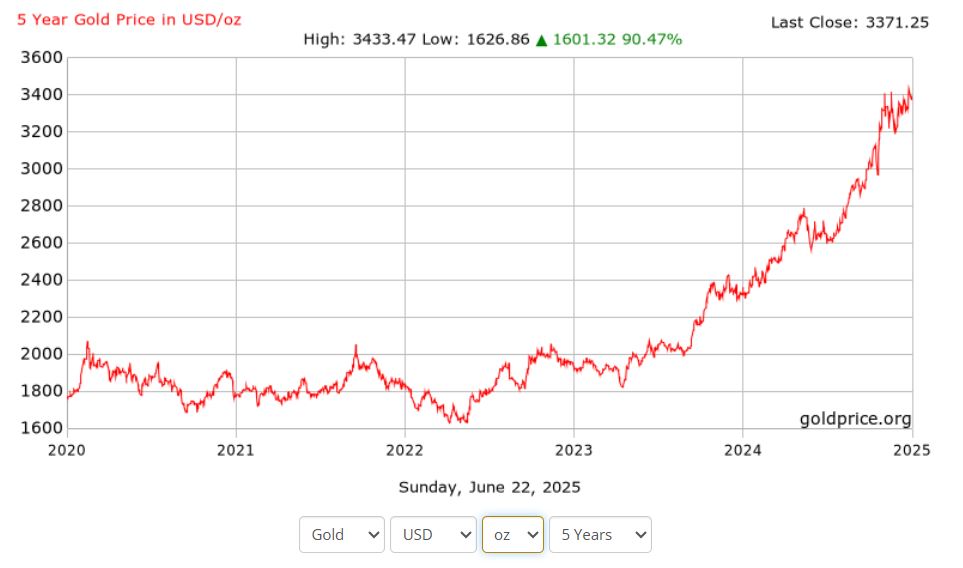

Understanding the Gold Price Surge

Why is gold price increasing in 2025? Here’s what’s happening:

- Bank of America’s Forecast: Citing rising U.S. deficits and long-term debt concerns, BofA projects gold may double its value from current levels.

- Geopolitical Tensions: While the Israel-Iran conflict captured headlines, analysts believe that long-term macroeconomic issues like U.S. debt are more influential on gold’s trajectory.

- Investors Seeking Safe Havens: With markets on edge, investors are turning to assets like gold for stability.

📌 Quote:

“The Israel-Iran war may fade, but the deficit is permanent.” – BofA Global Research

What’s Driving Gold Toward $4,000?

Let’s break it down:

💰 Rising U.S. Deficit

- The U.S. national debt has surpassed $34 trillion.

- Interest payments alone are becoming a huge burden, weakening the dollar.

- Gold becomes a hedge when fiat currencies struggle.

📈 Stubborn Inflation

- Despite Fed hikes, inflation isn’t backing down.

- Gold often thrives in inflationary environments.

🌍 Global Uncertainty

- Ongoing wars, trade tensions, and economic slowdowns make gold a safe bet.

Will Gold Price Go Up or Down in 2025?

Short Answer: Most likely up—but it’s not guaranteed.

Here’s why:

| Factor | Bullish Impact | Bearish Impact |

|---|---|---|

| U.S. Debt Crisis | ✅ Yes | ❌ No |

| High Interest Rates | ❌ No | ✅ Yes |

| Inflation | ✅ Yes | ❌ No |

| Strong Dollar Recovery | ❌ No | ✅ Yes |

| Geopolitical Conflicts | ✅ Yes | ❌ No |

What Experts Are Saying

- BofA: Predicts $3,000–$4,000 gold by late 2025.

- Goldman Sachs: Notes that if inflation persists, gold will climb.

- Kitco News: Reports increased demand from central banks buying gold as reserve.

📌 Stat to Watch:

Global central bank gold demand hit a record 1,136 tons in 2023 (source: World Gold Council).

FAQs About Gold Prices in 2025

What gold price today?

Check latest rates at GoldPrice.org. As of today, it’s around $2,350/oz.

Will gold price go down in 2025?

Unlikely unless inflation drops rapidly and the U.S. dollar strengthens significantly.

Why gold price is increasing?

Due to high inflation, U.S. debt, and geopolitical risks.

Who decides gold price?

Gold prices are set by global markets through futures trading, supply/demand, and central bank policy.

Could gold hit $5,000 an ounce?

Possible in extreme economic instability, but $4,000 is more realistic based on current trends.

Why gold price go down sometimes?

Short-term corrections due to interest rate hikes, dollar strength, or profit-taking by investors.

Is it good time to invest in gold?

If you’re looking for a hedge against uncertainty, many analysts say yes—especially with prices projected to climb.

Pro Tips Before Investing in Gold

- ✅ Diversify your portfolio (don’t go all in on gold).

- ✅ Track inflation reports and Fed interest rate decisions.

- ✅ Watch central bank movements (they’re buying gold heavily).

Is $4,000 Gold a Pipe Dream?

Gold isn’t just a shiny metal—it’s a reflection of fear, policy, and power. With BofA, Goldman Sachs, and global economists aligning on bullish predictions, betting against gold might be riskier than betting on it.

👉 So, will gold hit $4,000? It might. And if deficits deepen or tensions flare up again, don’t be shocked if we even see a price beyond that.

💬 Your Turn: Do you believe gold will hit $4,000? Let us know in the comments! Thanks ! Byteerahub

Related Articles

How to Do Social Media Marketing with AI: 2025 Guide

March 16, 2025